`Should central banks modify their inflation targeting framework when agents are boundedly rational?’

TU Wien, August 30th – September 1st 2023

This is a stand-alone research project (18611) funded by the Anniversary Fund (Jubiläumsfonds) of the Austrian National Bank (OeNB) from 2021 to 2025. The project is conducted at the Economics Research Unit at TU Wien.

Abstract:

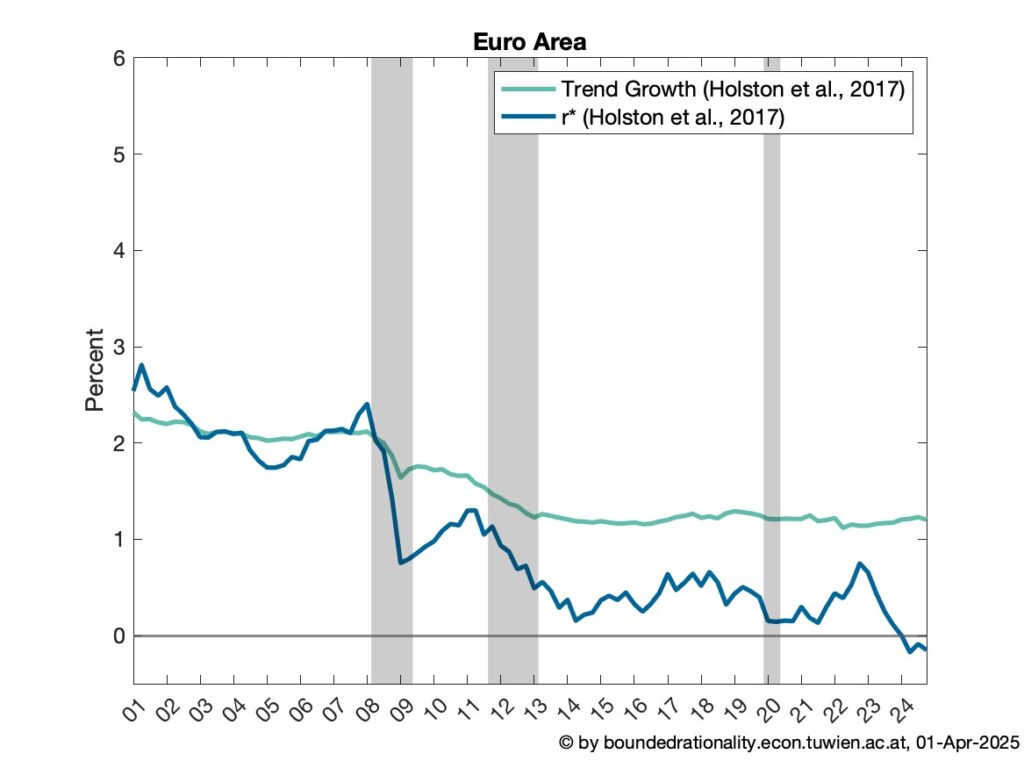

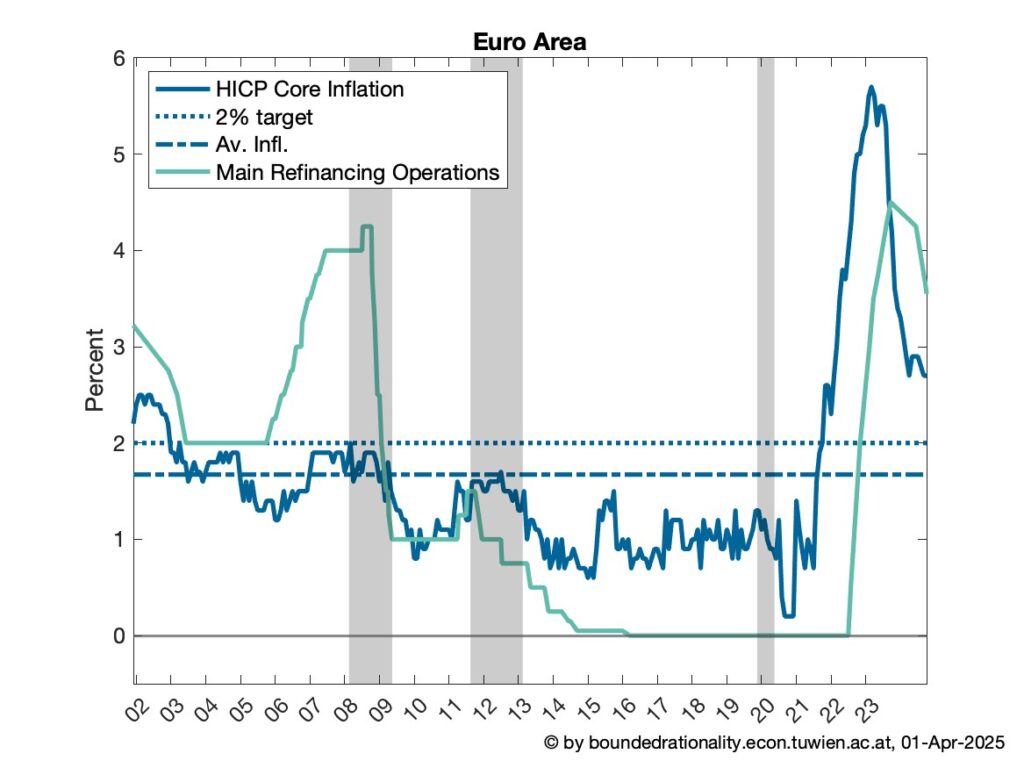

The COVID-19 recession materialized in an already challenging environment with low-interest rates and inflation. This environment implies that monetary policy is constrained more frequently and for longer periods by its effective lower bound (ELB).

The project’s central question: how can central banks reduce the ELB risk and provide sufficient stimulus when interest rates and inflation are low?

We address this question by examining major suggestions to modify the inflation targeting framework while highlighting the crucial role of expectations.

To this end, we implement boundedly rational agents with heterogeneous expectations under adaptive learning based on state-of-the-art micro-founded models.